For instance, rent and insurance on a factory building will be the same regardless if the factory is churning out a lot or a little in terms of quantity. Variable overhead, however, will increase along with the amount produced, such as raw materials or electricity. Suppose Connie’s Candy budgets capacity of production at \(100\%\) and determines expected overhead at this capacity. Connie’s Candy also wants to understand what overhead cost outcomes will be at \(90\%\) capacity and \(110\%\) capacity.

Actual Variable Manufacturing Overhead

Those costs are almost exclusively related to consumables, such as lubricants for machinery, light bulbs and other janitorial supplies. These costs are spread over the entire inventory since it is too difficult to track the use of these indirect materials. The expenses related to running and maintaining the corporate office are known as overhead costs. The overhead cost is an ongoing expense, which means that it must be paid on a continuous basis whether or not the company is meeting its sales or profit objectives. This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to better understand the variable overhead reduction. There are a few business expenses that remain consistent over time, but the exact amount varies, based on production.

What Is Variable Overhead Efficiency Variance

Measured at the originally estimated rate of $2 per direct labor hour, this amounts to $16 (8 hours x $2). As a result, this is an unfavorable variable manufacturing overhead efficiency variance. For example, DEF Toy is a toy manufacturer and has total variable overhead costs of $15,000 when the company produces 10,000 units per month. In the following month, the company receives a large order whereby it must produce 20,000 toys. At $1.50 per unit, the total variable overhead costs increased to $30,000 for the month. Utilities such as electricity and gas used in the production process also fall under variable overheads.

Manufacturing Overhead Calculation Example

For companies to operate continuously, they need to spend money on producing and selling their goods and services. The overall operation costs—managers, sales staff, marketing staff for the production facilities as well as the corporate office—are known as overhead. how do people and companies avoid paying taxes A favorable variance may occur due to economies of scale, bulk discounts for materials, cheaper supplies, efficient cost controls, or errors in budgetary planning. James Woodruff has been a management consultant to more than 1,000 small businesses.

Variable Overhead and Pricing

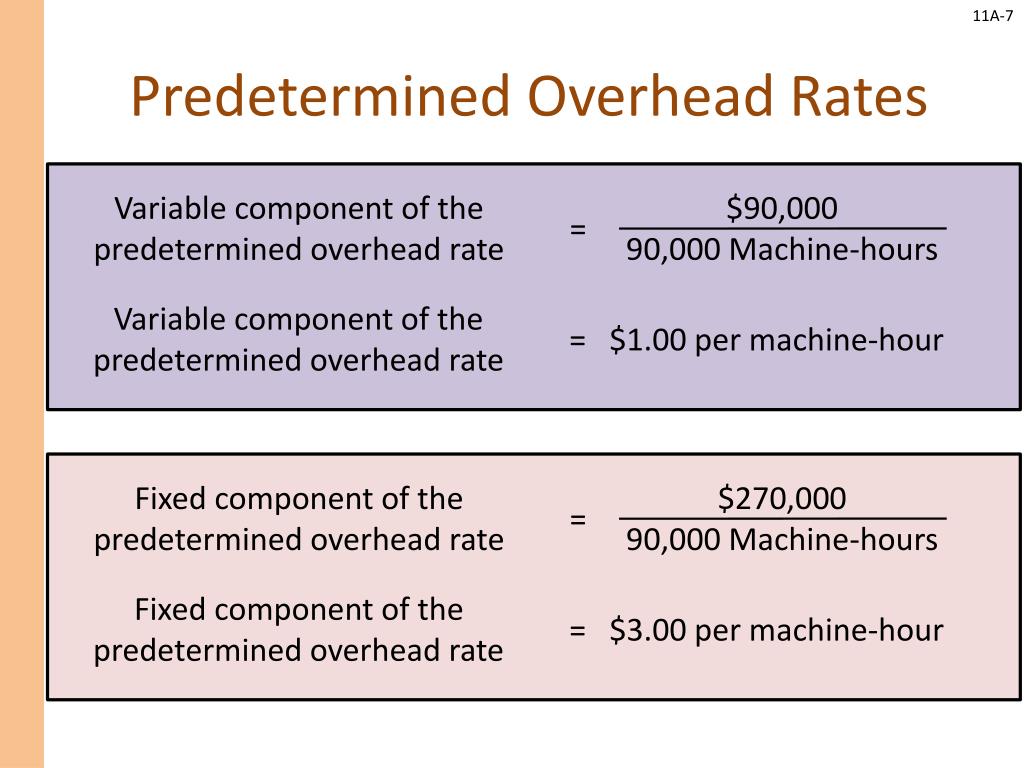

Manufacturing overhead is referred to as indirect costs because it’s hard to trace them to the product. That overhead absorption rate is the manufacturing overhead costs per unit, called the cost driver, which is labor costs, labor hours and machine hours. To determine the overhead standard cost, companies prepare a flexible budget that gives estimated revenues and costs at varying levels of production. The standard overhead cost is usually expressed as the sum of its component parts, fixed and variable costs per unit. Note that at different levels of production, total fixed costs are the same, so the standard fixed cost per unit will change for each production level. However, the variable standard cost per unit is the same per unit for each level of production, but the total variable costs will change.

Examples of Manufacturing Overhead Costs

- As a senior management consultant and owner, he used his technical expertise to conduct an analysis of a company’s operational, financial and business management issues.

- It is assumed that the additional 8 hours caused the company to use additional electricity and supplies.

- You can calculate applied manufacturing overhead by multiplying the overhead allocation rate by the number of hours worked or machinery used.

- With a selling price of $155 and a total production cost of $93.60, the gross profit becomes $61.40 per pair, or a gross margin of 40% ($61.40 divided by $155).

If you’d like to know the overhead cost per unit, divide the total manufacturing overhead cost by the number of units you manufacture. To know the exact number of units to manufacture for the next quarter, make a production budget. Employee training and involvement are equally important in managing these costs. A well-trained workforce is more efficient, which can lead to a reduction in indirect labor hours required for production.

Encouraging a culture of cost-awareness among employees can lead to more mindful use of resources and proactive identification of cost-saving opportunities. Indirect labor is another component, which refers to the wages of employees who are not directly involved in the production of goods but whose work is related to the production process. This includes maintenance workers who service the equipment and quality control inspectors who ensure the products meet certain standards. Their work is essential to the production process, yet their hours may increase or decrease based on the level of production. The key difference between variable and fixed overhead costs is that if production stopped for a period, there would be no variable overhead while fixed overhead remains. The fixed factory overhead variance represents the difference between the actual fixed overhead and the applied fixed overhead.

You probably keep up with the direct cost of labor and direct materials costs, and you’ve heard about allocating fixed overhead. Are variable manufacturing overhead expenses included in your standard costs budgets? Variable manufacturing overhead costs will increase in total as output increases. An example is the cost of the electricity needed to operate the machines that cut and sew the denim. Another example is the cost of the manufacturing supplies (such as needles and thread) that increase when production increases. We will assume that these variable manufacturing overhead costs fluctuate in response to the number of direct labor hours.

Looking at Connie’s Candies, the following table shows the variable overhead rate at each of the production capacity levels. In a good month, Tillery produces 100 shoes with indirect costs for each shoe at $10 apiece. The manufacturing overhead cost would be 100 multiplied by 10, which equals 1,000 or $1,000.