Variable and fixed costs play into the degree of operating leverage a company has. In short, fixed costs are more risky, generate a greater degree of leverage, and leave the company with greater upside potential. On the other hand, variable costs are safer, generate less leverage, and leave the company with a smaller upside potential.

Is salary a fixed or variable cost?

For example, Amy is quite concerned about her bakery as the revenue generated from sales are below the total costs of running the bakery. Amy asks for your opinion on whether she should close down the business or not. Additionally, she’s already committed to paying for one year of rent, electricity, and employee salaries. The following data will be used for three pairs of income statements that follow in sample problems. The only difference in the three scenarios is the number of units produced.

Which of these is most important for your financial advisor to have?

On the other hand, a low operating leverage means that the company’s expenses are primarily variable costs, implying less sensitivity to changes in sales. While increased sales may not dramatically improve profit margins in this scenario, the company is better positioned to withstand declines in sales without facing severe losses. Semi-variable costs, also known as mixed costs, are those costs that consist of both fixed and variable components. These costs can be challenging to analyze, as they change with the level of production but not proportionally. Different industries may have varying levels of variable costs, and companies must account for these costs in their financial statements and budgeting processes.

To Ensure One Vote Per Person, Please Include the Following Info

If Amy did not know which costs were variable or fixed, it would be harder to make an appropriate decision. In this case, we can see that total fixed costs are $1,700 and total variable expenses are $2,300. Because variable costs are tied to production, they are usually thought of as a constant amount of expense per unit produced. Variable costs stand in contrast with fixed costs since fixed costs do not change directly based on production volume. This can fluctuate based on various factors such as the price of raw materials or changes in labor costs.

The definition of a fixed cost is any expense you have to pay that doesn’t vary according to how much of your product or service you produce. Added up, your fixed costs are the price of staying in business—no matter how much business your business is doing. This formula helps businesses determine the expenses directly related to the production or sales volume of their products or services.

The primary components of variable costs include materials, labor, and utilities which are directly involved in the production process. Other possible variable expenses are commissions, packaging costs, and shipping expenses. A high operating leverage indicates that a company has a larger portion of fixed costs compared to variable costs, making it more sensitive to changes in sales. As sales increase, the company can generate a higher profit margin due to the reduced impact of variable costs on total expenses. Conversely, a decrease in sales, without adequately reducing fixed costs, can lead to a significant decline in profits.

- Over a one-day horizon, a factory’s costs might largely consist of fixed costs, not variable.

- Managers and others within a company use operating income as a measure for evaluating and improving operational performance.

- Lean management focuses on eliminating waste in all forms from the production process.

- Wood is considered a variable cost because the price of it can change over time.

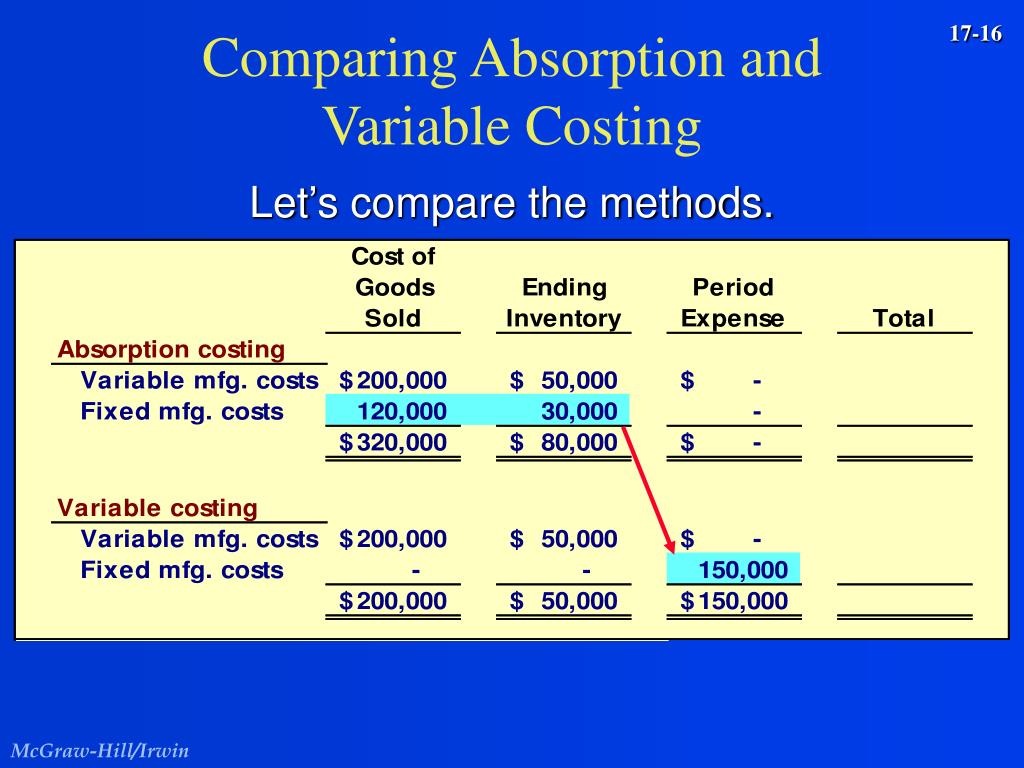

Variable selling andadministrative expenses are not part of product cost under eithermethod. To recap, the variable costing income statement is different from the absorption costing income statement in several ways. (1) Only variable production costs are included in cost of goods sold.

It is commonly used in managerial accounting and for internal decision-making purposes. how to pay taxes as a freelancer poorly upholds the matching principle, as related expenses are not recognized in the same period as related revenue. In our example above, under variable costing, we would expense all fixed manufacturing overhead in the period occurred.