When she’s not writing, Barbara likes to research public companies and play Pickleball, Texas Hold ‘em poker, bridge, and Mah Jongg. Learn about the time interest earned ratio and how to calculate it. The following are the disadvantages of the contribution margin analysis. One common misconception pertains to the difference between the CM and the gross margin (GM).

How To Use Contribution Margin Ratio With Other Numbers

These costs would be included when calculating the contribution margin. The contribution margin is the foundation for break-even analysis used in the overall cost and sales price planning for products. A contribution margin ratio of 40% means that 40% of the revenue earned by Company X is available for the recovery of fixed costs and to contribute to profit.

Do you own a business?

- For instance, a beverage company may have 15 different products but the bulk of its profits may come from one specific beverage.

- As another step, you can compute the cash breakeven point using cash-based variable costs and fixed costs.

- Alternatively, companies that rely on shipping and delivery companies that use driverless technology may be faced with an increase in transportation or shipping costs (variable costs).

- The break-even point in units is calculated as $466,000 divided by $3.05, which equals a breakeven point in units of 152,787 units.

- The contribution margin ratio represents a company’s revenue minus variable costs, divided by its revenue.

Thus, the total variable cost of producing 1 packet of whole wheat bread is as follows. For a quick example to illustrate the concept, suppose there is an e-commerce retailer selling t-shirts online for $25.00 with variable costs of $10.00 per unit. In particular, the use-case of the contribution margin is most practical for companies in setting prices on their products and services appropriately to optimize their revenue growth and profitability potential. The contribution margin (CM) is the profit generated once variable costs have been deducted from revenue.

How to Conduct an Accounts Payable Audit: What You Should Know

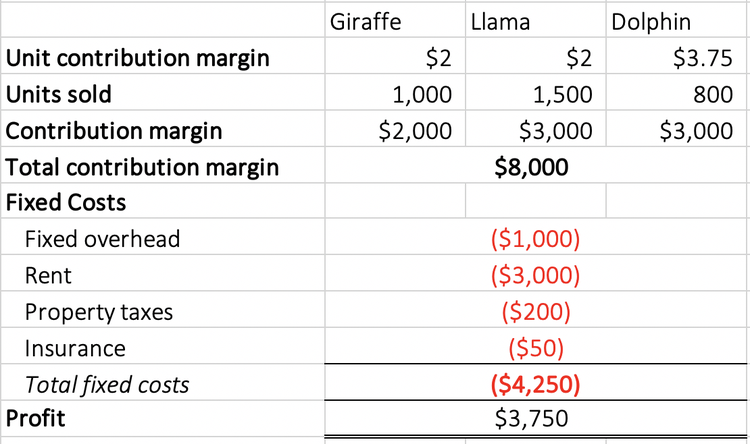

Calculating your contribution margin helps you find valuable business solutions through decision-support analysis. In short, profit margin gives you a general idea of how well a business is doing, while contribution margin helps you pinpoint which products are the most profitable. To illustrate how this form of income statement can be used, contribution margin income statements for Hicks Manufacturing are shown for the months of April and May. Let’s look at an example of how to use the contribution margin ratio formula in practice.

Contribution Margin Ratio: Formula, Definition, and Examples

Say, your business manufactures 100 units of umbrellas incurring a total variable cost of $500. Accordingly, the Contribution Margin Per Unit of Umbrella would be as follows. To calculate the contribution margin, we must deduct the variable cost per unit from the price per unit.

It can also be an invaluable tool for deciding which products may have the highest profitability, particularly when those products use equivalent resources. In general, the higher the contribution margin ratio, the better, with negative numbers indicating a loss on every unit produced. Therefore, the unit contribution margin (selling price per unit minus variable costs per unit) is $3.05. The company’s contribution margin of $3.05 will cover fixed costs of $2.33, contributing $0.72 to profits. For the month of April, sales from the Blue Jay Model contributed \(\$36,000\) toward fixed costs. Looking at contribution margin in total allows managers to evaluate whether a particular product is profitable and how the sales revenue from that product contributes to the overall profitability of the company.

For example, it can help a company determine whether savings in variable costs, such as reducing labor costs by using a new machine, justify the increase in fixed costs. This assessment ensures investments contribute positively to the company’s financial health. Companies often look at the minimum price at which a product could sell to cover basic, fixed expenses of the business.

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, margin of safety and links. If the company realizes a level of activity of more than 3,000 units, a profit will result; if less, a loss will be incurred. With the help of advanced artificial intelligence, Sling lets you set projected labor costs before you schedule your employees so you know what the wage ceiling will be before putting names to paper.