Small differences in prices of your supplies can make a huge difference in the profitability of a company. There is no definitive answer to this question, as it will vary depending on the specific business and its operating costs. However, a general rule of thumb is that a Contribution Margin above 20% is considered good, while anything below 10% is considered to be relatively low.

Defining the Contribution Margin

Before making any changes to your pricing or production processes, weigh the potential costs and benefits. Let’s say we have a company that produces 100,000 units of a product, sells them at $12 per unit, and has a variable costs of $8 per unit. The contribution margin represents the revenue that a company gains by selling each additional unit of a product or good. This is one of several metrics that companies and investors use to make data-driven decisions about their business.

What is a Good Contribution Margin?

Direct Costs are the costs that can be directly identified or allocated to your products. For instance, direct material cost and direct labor cost are the costs that can be directly allocated with producing your goods. While there are plenty of profitability metrics—ranging from the gross margin down to the net profit margin—the contribution margin metric stands out for the analysis of a specific product or service. The concept of contribution margin is applicable at various levels of manufacturing, business segments, and products.

- Therefore, we will try to understand what is contribution margin, the contribution margin ratio, and how to find contribution margin.

- One reason might be to meet company goals, such as gaining market share.

- Knowing your company’s variable vs fixed costs helps you make informed product and pricing decisions with contribution margin and perform break-even analysis.

- Now, the fixed cost of manufacturing packets of bread is $10,000.

- We may earn a commission when you click on a link or make a purchase through the links on our site.

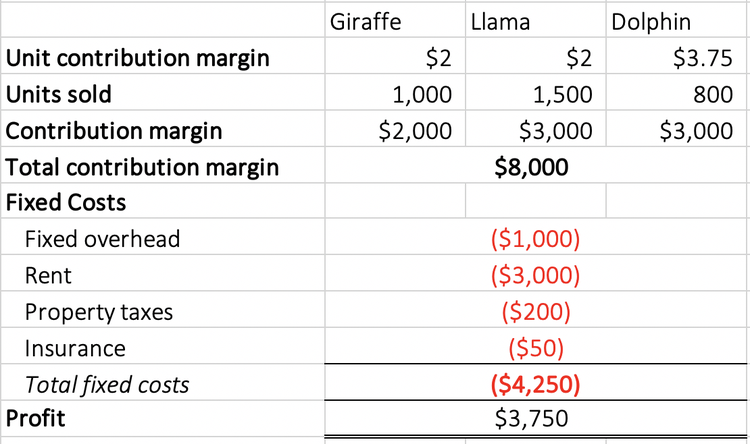

Contribution Margin for Overall Business in Dollars

Thus, at the 5,000 unit level, there is a profit of $20,000 (2,000 units above break-even point x $10). See in real-time what each shift will cost your business and adjust the expenses accordingly. The contribution margin is given as a currency, while the ratio is presented as a percentage. Thus, to arrive at the net sales of your business, you need to use the following formula. For instance, in Year 0, we use the following formula to arrive at a contribution margin of $60.00 per unit. A good contribution margin is all relative, depending on the nature of the company, its expense structure, and whether the company is competitive with its business peers.

You can calculate the contribution margin by subtracting the direct variable costs from the sales revenue. As another step, you can compute the cash breakeven point using cash-based variable costs and fixed costs. Compare the lines for determining accrual basis breakeven and cash breakeven on a graph showing different volume levels. Calculating contribution margin (the difference between sales revenue and variable costs) is an effective financial analysis tool for making strategic business decisions.

This analysis can aid in setting prices, planning sales or discounts, and managing additional costs like delivery fees. For example, a company aspiring to offer free delivery should achieve a scale where such an offering doesn’t negatively impact profits. The first step to calculate the contribution margin is to determine the net sales of your business. Net sales refer to the total revenue your business generates as a result of selling its goods or services. Dobson Books Company sells textbook sets to primary and high schools.

Say a company could make three different products on one machine. Assuming factors like demand and competition are equal, the company should make the product with the highest return relative to variable costs in order to maximize profits. Furthermore, this ratio is also useful in determining the pricing of your products and the impact on profits due to change in journal entries examples format how to explanation sales. Accordingly, in the Dobson Books Company example, the contribution margin ratio was as follows. This is because the contribution margin ratio lets you know the proportion of profit that your business generates at a given level of output. Thus, the contribution margin ratio expresses the relationship between the change in your sales volume and profit.

It is often used for building a break-even analysis, which helps companies determine at what point a new business project will reach enough sales to cover the costs. You’ll often turn to profit margin to determine the worth of your business. It’s an important metric that compares a company’s overall profit to its sales. However, if you want to know how much each product contributes to your bottom line after covering its variable costs, what you need is a contribution margin. In our example, the sales revenue from one shirt is \(\$15\) and the variable cost of one shirt is \(\$10\), so the individual contribution margin is \(\$5\). This \(\$5\) contribution margin is assumed to first cover fixed costs first and then realized as profit.

These costs may be higher because technology is often more expensive when it is new than it will be in the future, when it is easier and more cost effective to produce and also more accessible. The same will likely happen over time with the cost of creating and using driverless transportation. The CVP relationships of many organizations have become more complex recently because many labor-intensive jobs have been replaced by or supplemented with technology, changing both fixed and variable costs.

Whereas, your net profit may change with the change in the level of output. Thus, you need to make sure that the contribution margin covers your fixed cost and the target income you want to achieve. The profitability of our company likely benefited from the increased contribution margin per product, as the contribution margin per dollar increased from $0.60 to $0.68. Next, the CM ratio can be calculated by dividing the amount from the prior step by the price per unit. The analysis of the contribution margin facilitates a more in-depth, granular understanding of a company’s unit economics (and cost structure).